Cash in Transit Vehicles: Essential Transport Solutions for Secure Money Handling

Introduction

Cash in transit (CIT) vehicles are specialized transport solutions designed to safely move cash and other valuables between locations. With the rise in criminal activities targeting cash deliveries, the significance of secure transportation has never been more critical. This article provides an in-depth look at cash in transit vehicles, discussing their features, types, regulations, and why they are vital for businesses that handle large amounts of cash.

What are Cash in Transit Vehicles?

Cash in transit vehicles are armored or specially modified vehicles used by banks, armored car services, and businesses to transport money, sensitive documents, and valuables. These vehicles are often heavily fortified to withstand attacks and are equipped with advanced security features such as tracking systems, alarms, and bulletproof glass.

Features of Cash in Transit Vehicles

Armoring and Construction

Cash in transit vehicles are constructed with reinforced materials, including steel plating and bullet-resistant materials. This armoring is crucial for protecting crews and cargo from potential threats.

Security Systems

Most CIT vehicles come equipped with high-tech security systems, including:

- GPS Tracking: Allows for real-time monitoring of the vehicle’s location.

- CCTV Cameras: Used to record activities inside and outside the vehicle.

- Alarm Systems: Alerts security personnel and authorities in case of a break-in.

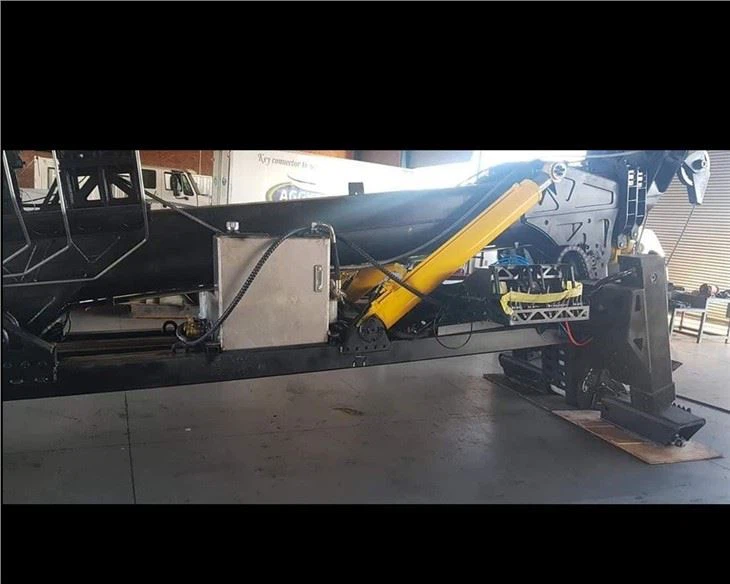

Vehicle Design

The design of CIT vehicles is often optimized not just for security, but also for mobility and visibility. Many vehicles are built on commercial truck chassis, ensuring durability and strength while remaining recognizable as an armored vehicle.

Types of Cash in Transit Vehicles

Armored Trucks

Armored trucks are the most common type of CIT vehicles. They are usually heavier and can carry larger amounts of cash and valuables. These trucks often cater to large organizations such as banks or government facilities.

Armored Vans

Armored vans are smaller than trucks and are ideal for transporting cash within urban environments. Their size allows for easier navigation through traffic while still providing adequate protection.

Specialized Vehicles

Some CIT vehicles are tailored for specific industries, such as retail or casinos. These vehicles may come with specialized locking mechanisms and storage compartments designed to protect high-value items.

Importance of Cash in Transit Vehicles

Mitigating Theft and Loss

The primary function of CIT vehicles is to prevent theft and ensure the safety of cash and valuables. With increasing crime rates, they help businesses mitigate losses associated with cash transport.

Insurance and Liability Considerations

By using CIT vehicles, companies can often secure better insurance rates as the risk of loss decreases. Insurers recognize the added layer of security these vehicles provide.

Convenience for Businesses

CIT services allow businesses to focus on their core operations without worrying about cash management. Regular pickups and deliveries can be scheduled, providing consistent cash flow.

Regulations Surrounding Cash in Transit Vehicles

Licensing and Certification

In many jurisdictions, companies operating CIT vehicles must comply with local regulations, which may include obtaining special licenses and certifications to operate armored vehicles.

Training for Personnel

Personnel must undergo specialized training on safety, security protocols, and emergency response procedures to handle cash transport safely.

Compliance with Local Laws

Cash in transit companies need to adhere to laws regarding gem transport, tax regulations, and internal controls outlined by financial authorities.

Practical Tips for Choosing a Cash in Transit Service

Assessing Security Features

When selecting a CIT service, evaluate the vehicle’s security features, including armoring, tracking capabilities, and whether they have a 24/7 monitoring system in place.

Experience and Reputation

Choose a company with a solid reputation and extensive experience in the industry. Look for reviews and client testimonials to gauge reliability.

Cost of Service

Evaluate the cost of service against the features offered. Ensure you understand what is included in the pricing, including insurance coverage and emergency response protocols.

Monitoring and Communication

Ensure that the CIT service provides adequate communication channels to keep you informed during transportation and in the event of any emergencies.

Benefits of Using Cash in Transit Vehicles

Enhanced Security

Cash in transit vehicles are specifically designed to deter crime and provide a secure means for transporting cash and valuables. Their specialty constructions make them much less likely to be targeted than standard delivery vehicles.

Lower Insurance Costs

Using CIT vehicles usually results in lower insurance premiums due to reduced risk. Insurers appreciate the improved security measures that protect valuable assets.

Increased Trust and Customer Satisfaction

Customers feel more secure knowing that businesses are taking proactive steps to protect their money. This can lead to greater customer loyalty and satisfaction.

Challenges Facing Cash in Transit Vehicles

Rising Costs

The costs of maintaining and operating cash in transit vehicles can be high. This includes fuel, insurance, and the salaries of trained personnel.

Evolving Crime Techniques

As crime evolves, so do the methods used by criminals. CIT companies must continually adapt their security measures to stay one step ahead of potential threats.

Regulatory Compliance

Keeping up with ever-changing laws and regulations can be challenging. Companies must stay informed about licensing, required equipment, and personnel training protocols.

Future Trends in Cash in Transit Vehicles

Technological Advancements

The future of cash in transit vehicles looks to incorporate advanced technologies such as AI-driven security systems, enhanced GPS tracking, and robotics for armed escorts.

Shift towards Contactless Payments

With the rise of digital currencies and contactless payment methods, the demand for cash in transit vehicles may evolve accordingly. Companies may focus on electronic cash transport systems.

Increased Demand for Transparency

As clients demand more transparency in how their cash is handled, CIT companies will need to provide detailed tracking and reporting of cash movements.

Frequently Asked Questions (FAQs)

What is the primary function of cash in transit vehicles?

The primary function of cash in transit vehicles is to securely transport cash and valuables between locations, ensuring safety and reducing the risk of theft.

Are all cash in transit vehicles armored?

While most cash in transit vehicles are armored, there are variations. Some may be specialized vans that provide necessary security features without being heavily armored.

How do I choose a reliable cash in transit service?

When selecting a CIT service, consider their reputation, the security features of their vehicles, their experience in the industry, and the cost of their services.

What security features should I look for in a cash in transit vehicle?

Key security features to look for include GPS tracking, CCTV cameras, alarm systems, reinforced body construction, and trained personnel.

What are the main challenges faced by cash in transit services?

Challenges include rising operational costs, evolving crime techniques, and the need for regulatory compliance, which can all impact service delivery.

Will cash in transit vehicles still be necessary in the future?

Despite the rise of digital payments, cash in transit vehicles will remain essential for businesses that deal with cash, although their roles may evolve with technological advancements.